Cardinal Capital Management, Inc. today announced that it has been awarded a 6-Star Top Guns Manager designation by Informa Financial Intelligence’s PSN manager database. The award recognizes Cardinal Capital’s Balanced composite’s outstanding performance over the past five years, as measured by its ability to consistently outperform its benchmark and peers.

“We are honored to be recognized by PSN for our investment performance,” said Glenn C. Andrews, President and Chief Investment Officer of Cardinal Capital. “This award is a testament to the hard work and dedication of our investment team, who are committed to providing our clients with superior investment returns.”

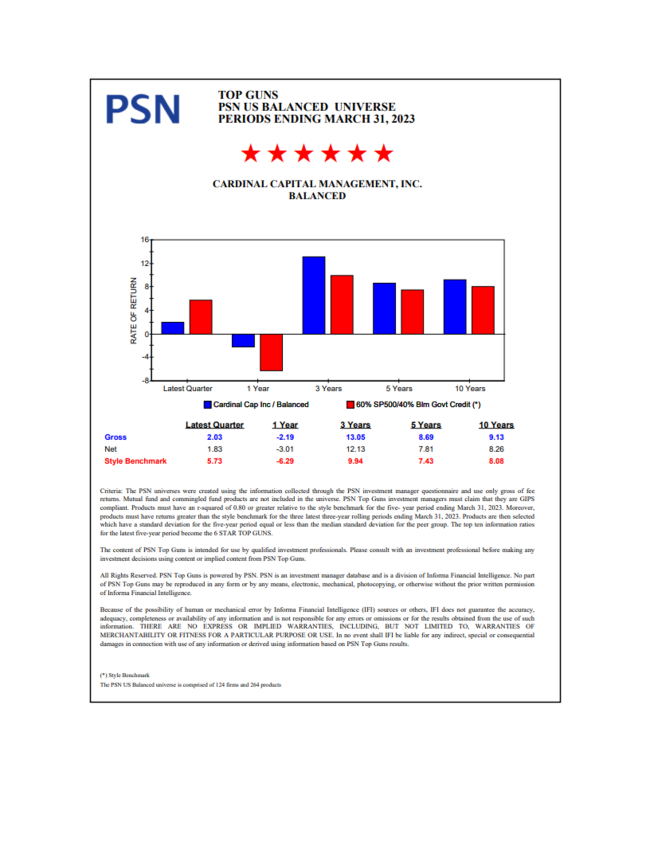

To be eligible for the 6-Star Top Guns Manager designation, a firm must meet a number of stringent criteria, including:

- Returns that exceed the style benchmark for the three latest three-year rolling periods

- A standard deviation for the five-year period that is equal or less than the median standard deviation for the peer group

- An R-squared of 0.80 or greater relative to the style benchmark for the recent five-year period

Cardinal Capital Management’s Balanced Portfolio composite is comprised of approximately 70% U.S. Large Cap equities, 25% high-quality bonds of laddered maturities and 5% cash. The Balanced Portfolio seeks long-term capital appreciation by predominantly investing in dividend paying U.S. equities with lower volatility in an effort to enhance the portfolio’s overall returns while at the same time allocating 25% to high- quality laddered maturity bonds in order to generate income and further reduce equity volatility.

“We are proud to recognize Cardinal Capital as a 6-Star Top Guns Manager,” said Margaret Tobiasen, SVP of Data Distribution for Informa Financial Intelligence. “This award is a testament to Cardinal Capital’s commitment to excellence and its ability to consistently deliver superior investment performance for its clients.”

Through a combination of PSN’s proprietary performance screens, the PSN Top Guns List ranks products in six proprietary categories in over 75 universes based on continued performance over time. The complete list of PSN Top Guns and an overview of the methodology can be located on https://psn.fi.informais.com/. Registration is required.

About Cardinal Capital Management, Inc.

Cardinal Capital Management Inc. is an independent registered investment management firm established in 1992, that manages equity, fixed income and balanced assets for U.S. clients. The company’s clients include individuals, trusts, corporations, and foundations. Cardinal Capital Management claims compliance with the Global Investment Performance Standards (GIPS®). A complete list of composite descriptions and compliant presentations are available by calling (919) 532-7500 or contacting Wes Andrews at wandrews@cardinalcapitalmanagement.com. For more information, please visit http:// www.cardinalcapitalmanagement.com.

About PSN

For nearly four decades, PSN has been a top resource for investment professionals. Asset managers rely on Zephyr’s PSN to effectively reach institutional and retail investors. Over 2,800 firms, 285 universes, and more than 21,000 products comprise the PSN SMA database showing asset breakdowns, compliance, key personnel, ownership diversity, ESG, business objectives and strategy, style, fees, GIC sectors, fixed income ranges and full holdings. Unique to PSN is its robust historical database of nearly 40 Years of Data Including Net and Gross-of-Fee Returns. For more details on the methodology behind the PSN Top Guns Rankings or to purchase PSN Top Guns Reports, contact Margaret Tobiasen at Margaret.tobiasen@informa.com. Visit PSN online to learn more.

Cardinal Capital Management Media Contact:

Wes Andrews Cardinal Capital Management, Inc.

wandrews@cardinalcapitalmanagement.com

(800) 625-2335

Cardinal Capital Management Disclaimer

Performance results represent composite results for the Balanced strategy managed by Cardinal Capital Management, Inc. (“Cardinal”) during the corresponding time periods. The performance results reflect the reinvestment of dividends and other account earnings, and are net account transaction and custodial charges, and Cardinal’ s investment management fee except for those performance returns that are compared to other similarly benchmarked managers (for example, managers whose performance is compared to a blended benchmark comprised of 60% S&P 500 Composite Index and 40% Bloomberg Barclays Government Credit Index) in charts which results were prepared utilizing investment managers database and the PSN investment managers database which are reported gross of investment management fees, including Cardinal management fee- (see Gross of Fees disclosure below).

Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that future performance will be profitable, or equal either the Cardinal performance results reflected or any corresponding historical benchmark index. The S&P 500 Composite Index (the “S&P) is a market capitalization-weighted index of 500 widely held stocks often used as a proxy for the stock market. Standard & Poor’s chooses the member companies for the S&P based on the market size, liquidity, and industry group representation. Included are the common stocks of industrial, financial, utility, and transportation companies. The historical performance results of the S&P (and those of or all indices) do not reflect the deduction of transaction and custodial charges, nor the deduction of an investment management fee, the incurrence of which would have the effect of decreasing indicated historical performance results. The historical S&P performance results (and those of all other indices) are provided exclusively for comparison purposes only, so as to provide general comparative information to assist an individual client or prospective client in determining whether the performance of a Cardinal portfolio meets, or continues to meet, his/her investment objective(s). It should not be assumed that Cardinal account holdings will correspond directly to the S&P or any other comparative index. The Cardinal performance results do not reflect the impact of taxes.

For reasons including variances in portfolio account holdings, variances in the investment management fee incurred, market fluctuation, the date on which a client engaged Cardinal’s investment management services, and account contributions or withdrawals, the performance of a specific client’s account may have varied substantially from the indicated Cardinal portfolio performance results. Cardinal Capital Management’s compliance with the GIPS standards has been verified for the period April 1, 2017 through September 30, 2019 by ACA Performance Services LLC and between the periods April 1, 1992 through March 31, 2017 by Ashland Partners & Company LLP. In addition, a performance examination was conducted on the Balanced composite beginning October 31, 1992 through September 30, 2019. A copy of the verification report is available upon request. Information pertaining to Cardinal’s advisory operations, services, and fees is set forth in Cardinal’s current disclosure statement a copy of which is available from Cardinal upon request.

Gross of Fees (charts from PSN investment managers database) Comparative managers’ investment performance is shown in these charts gross of their management fees and Cardinal’s investment performance is shown gross of Cardinal’s investment management fees (as described in Cardinal’s written disclosure statement), the incurrence of which will have the effect decreasing the composite performance results (for example: an advisory fee of 1% compounded over a 10-year period would reduce a 10% return to a 9% annual return).